Content

Since unit sales and units of production are easily traceable to a division, sales revenue and variable expenses are generally easy to allocate to a specific segment. Traceable fixed costs are crucial for management decisions. They allow managers to make informed decisions about the profitability of a particular responsibility center.

- Ted income statement and a contribution margin income statement.

- A contribution margin income statement for the total company and an example of the company’s segments are presented in Exhibit 5-1.

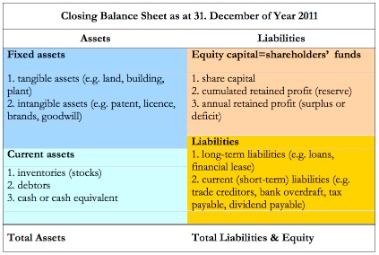

- Thus common costs will not disappear if the center is discontinued.

- Don’t allocateDon’t allocate common costs.common costs.

- The common fixed cost is the cost that a company spends to provide benefits to all branches, locations, and segments.

Companies must assign these costs to the relative centers based on an allocation basis. In addition to companywide income reporting, managers or owners also need to measure the profitability of individual segments within their organizations. Anorganizational segment is a part or activity within an organization about which managers would like cost, revenue, or profit data. Organizational segments can include divisions, individual stores, geographic regions, customers, or product lines. For example, Graeters Ice Cream will look at the profitability of the company as a whole as well as the profitability of each individual retail location. The individual stores are considered segments within the organization.

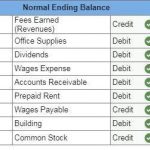

Definition of «Traceable Fixed Expenses»

And if the segment is a business unit, the margin of the segment will depend on the margin of contribution for all products, and the fixed cost will be traced to the department. A segment margin is computed by deducting variable and traceable fixed expenses from the sales of a segment. Only those fixed cost labeled common are charged to the individual segments when preparing a segmented income statement. Quick Check Suppose square feet is used as the basis for allocating the common fixed cost of $200,000.

Full feedback is not available online. Homework questions can be assigned, with auto-grading and export, to specific learning management platforms, e.g., Canvas, Blackboard, etc. Contact the author for details.

Common Fixed Cost Example

Describe three transfer pricing methods and explain when each Is useful. Distinguish between prime costs and conversion costs. Explain the difference between prime costs and conversion costs. Need a deep-dive on the concept behind this traceable fixed costs application? Learn more about this topic, accounting and related others by exploring similar questions and additional content below. Homework questions can be used for additional practice or can be assigned in an academic setting.

What is an example of traceable fixed costs?

For example, if a company produces shoes and clothing, the salary of the manager of the shoe segment is a traceable fixed expense because it does not change based on sales revenue and it would not exist if the company eliminated the shoe department.